Financially Sound

Get fast and straightforward services wherever you are. A single document is all it takes

Get fast and straightforward services wherever you are. A single document is all it takes

A responsible lending approach with a focus on security. We safeguard your information and provide help in tough spots

Simple solutions from home, fast. Instant money in your account and flexible loan terms

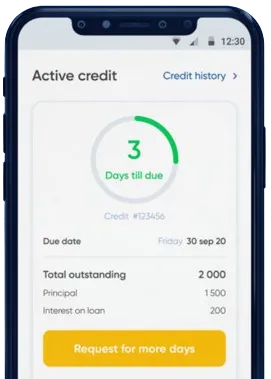

Send in your loan application using our app by filling out a quick form.

Wait briefly for our decision, typically 15 minutes.

Get your loan deposited, typically in just one minute.

Send in your loan application using our app by filling out a quick form.

Download loan app

Mobile loans have become increasingly popular in Kenya due to their convenience, accessibility, and ease of use. These loans, which are disbursed through mobile money platforms, have revolutionized the way Kenyans access credit. Here are some of the key benefits of mobile loans in Kenya:

One of the biggest advantages of mobile loans is the convenience they offer. With just a few taps on your mobile phone, you can apply for a loan and receive the funds directly in your mobile money account within minutes. This eliminates the need to visit a physical bank branch or fill out lengthy application forms.

Additionally, mobile loans cater to the unbanked and underbanked populations in Kenya, who may not have access to traditional banking services but have a mobile phone.

Mobile loans in Kenya have significantly reduced the time it takes to access credit. The application process is usually simple and straightforward, requiring minimal documentation. This, coupled with the use of algorithms to assess creditworthiness, allows for quick approval and disbursement of funds.

Studies show that the average time it takes to receive a mobile loan in Kenya is less than 6 hours, compared to traditional bank loans which can take days or even weeks.

Mobile loans in Kenya offer borrowers flexibility in terms of loan amounts and repayment plans. Borrowers can choose the amount they need and select a repayment schedule that suits their financial situation. Additionally, some mobile loan apps offer the option to extend the loan duration or refinance the loan if needed.

Mobile loans have played a significant role in promoting financial inclusion in Kenya. By providing access to credit to individuals who would otherwise be excluded from the formal financial system, mobile loans help bridge the financial gap and empower borrowers to meet their financial needs.

Research indicates that the use of mobile loans has led to increased financial literacy among Kenyans, as borrowers become more aware of various financial products and services available to them.

Mobile loans in Kenya offer numerous benefits to borrowers, including convenience, quick disbursement, flexibility, and financial inclusion. As the mobile lending industry continues to grow, it is essential for borrowers to understand the terms and conditions of mobile loans to make informed financial decisions.

Mobile loans in Kenya are short-term loans that can be applied for, processed, and disbursed through mobile phone platforms. These loans are typically offered by mobile loan providers such as M-Pesa, Tala, Branch, and others.

To qualify for a mobile loan in Kenya, you typically need to have an active mobile money account, a good repayment history, and a valid ID. Some providers may also require you to have a certain minimum income level and be above a certain age.

The maximum amount you can borrow with a mobile loan in Kenya varies depending on the provider. Generally, the maximum loan amount ranges from Ksh 500 to Ksh 100,000 or more, with some providers increasing your limit based on your repayment history.

The repayment period for mobile loans in Kenya is usually short, ranging from 7 days to 30 days. Some providers may offer longer repayment periods for larger loan amounts, but it is important to repay the loan within the specified timeframe to avoid penalties.

If you fail to repay your mobile loan on time, you may incur late payment fees, attract high-interest rates on the outstanding amount, or risk being listed on credit reference bureaus. This can negatively impact your credit score and limit your access to credit in the future.

Yes, you can borrow multiple mobile loans at the same time in Kenya from different providers. However, it is important to borrow only what you can afford to repay to avoid falling into a cycle of debt. Make sure to carefully manage your loan repayments and avoid overborrowing.